5 tips for accelerating business growth

Accelerating business growth doesn’t need to remain out of reach. With these top tips, you or your clients can get the boost needed to reach the next level.

As the world rapidly changes, customer behavior is influenced by and can lead to new expectations placed on your business. If you can meet those expectations (maybe even before the customer starts searching), you’ll beat your competition to the punch.

Satisfying this consumer desire is the name of the game. Today’s customer wants a personalized experience instead of irrelevant ads and offers. They want products and services designed specifically for them. Fortunately, companies can create personalized experiences through effective targeting and audience segmentation.

Here are some ways to keep things personal and start accelerating business growth:

Stay in touch…with the times

Customers will continue to change as the world changes, and staying out-of-touch with reality can deteriorate your market share over time.

Just as Kodak refused to adapt to digital photography, not wanting to take a short-term hit in exchange for long-term sustainability, today’s businesses will also fail if they refuse to adapt.

Trends will force change in every industry, so your organization will need to stay up-to-date with the latest innovations and customer demands. Look for these trends in industry publications, research reports and competitive activities — then adjust your strategy as needed.

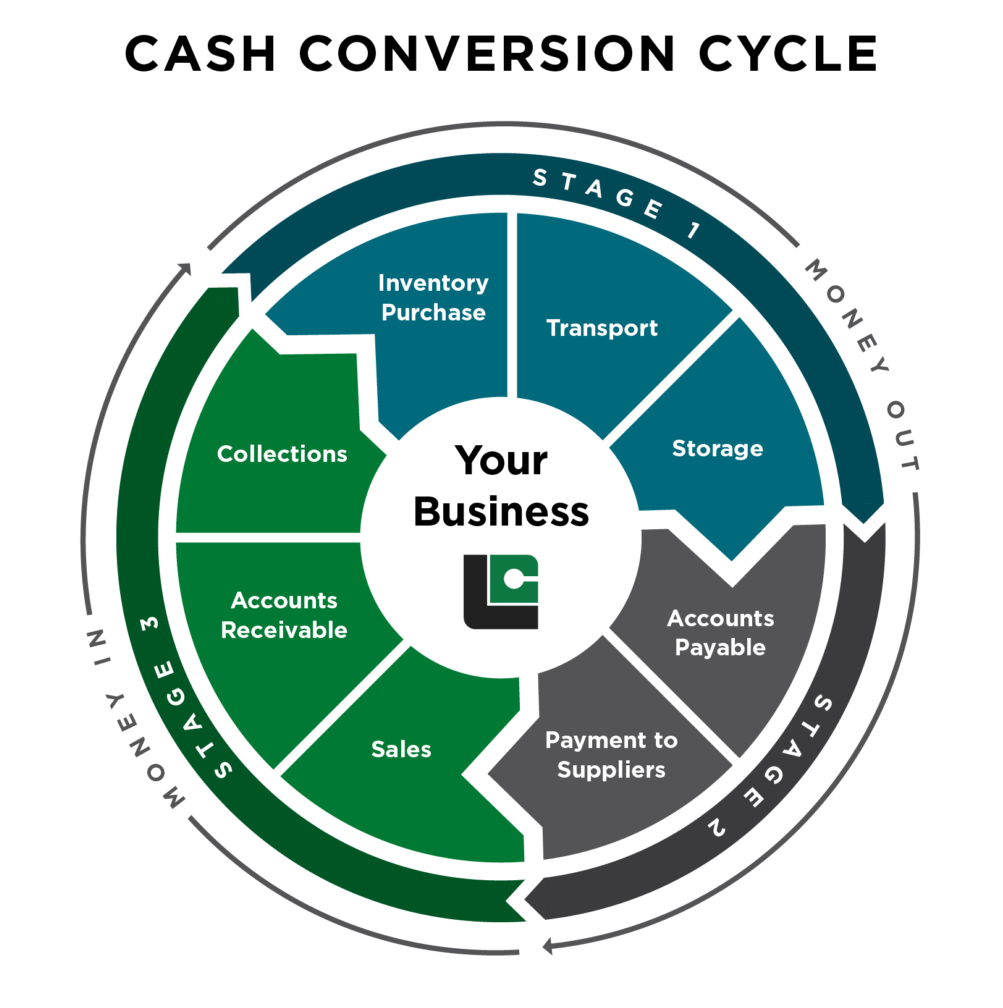

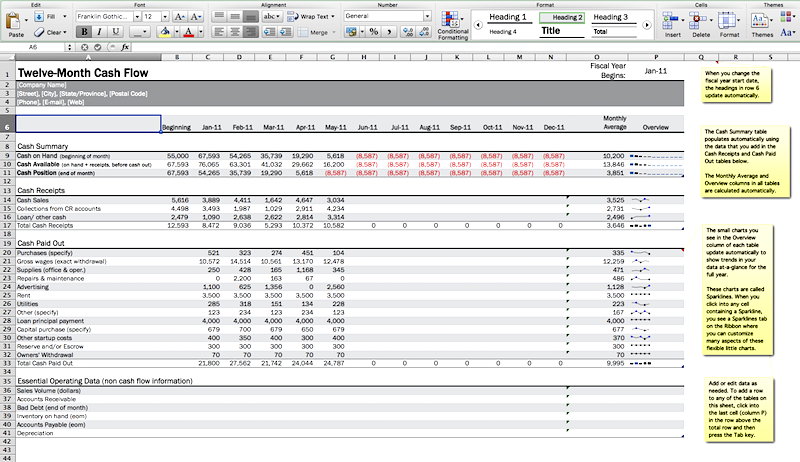

If your business needs extra funds to hire people, run new campaigns, increase manufacturing levels, change inventory or perform other essential functions to adjust, your cash flow will be critical. Leaders and CFOs will need to keep an eye on this working capital and ensure they have enough ready to make those changes.

Create systems

Internal systems can improve any part of your business. For example, you can increase employee productivity with time tracking and project management tools, just as you can improve profits with suitable financial systems in place.

Establish workflows for your team and ask them for suggestions. Everyone in the organization should have valuable input, since even some front-line workers know more about the day-to-day operations than executives who might be more focused on higher-level strategy. These employees can tell you about glaring problems and present systems or ideas to tackle issues.

Systems ensure operations run smoother in your business so that everyone knows when to perform specific tasks and how to do them. This synergy will lead to strong teams.

Analyze customer data to fuel business growth

Customers remain the focal point of accelerating business growth, and data helps us track how they engage with our brands and offers. It’s no wonder every scaling business analyzes data to make better decisions.

You can analyze traffic growth and trends, but nothing beats customer data. Check your conversion rates across ads, landing pages and other assets.

An opt-in page with a 20% conversion rate does more for your business than one with just 10%, since you’ll be building more business contacts and a larger funnel of opportunity. If the data tells you to spend more time promoting the most successful page, then do it. The data is almost always right.

Overall, providing customers with more of what they want will make them loyal and lead to higher conversion rates.

Study your competition

Your competitors also want to grow, and they will implement strategies they believe will lead to more growth.

Since your growth initiatives will have some overlap with competitors, learn from what they’re doing. For example, you might both use Facebook Ads or actively seek out specific skills, but each business has its differences and you can stand out compared to the other companies in your market.

Look for nuances in your competitor’s strategies that differ from yours, which can reveal new opportunities to gain attention from your target market. For example, a top competitor may focus their efforts on large events. Similarly, but different, you can experiment with smaller local events and gain traction in that more niche market, not saturated by a flood of competition.

Your competition also provides many business growth ideas. Subscribe to their email lists and follow them on social media. See how they interact with their audiences and which strategies they use often.

Is a competitor running their 10th giveaway of the year? That level of consistency means giveaways work for your competitor.

You can also abandon strategies that your competitors leave alone. Learn from their mistakes, so you avoid them for your company. Or fine-tune your approach to improve upon things that didn’t quite work in the past.

Double down on social media

While billions of people use social media to interact with their friends and brands, exploring clever hacks, fun videos and finding great product recommendations, most social networks don’t lead to direct sales. After all, few followers will see your Instagram post and feel compelled to immediately buy your product.

For many brands, social media is about establishing a presence, gaining awareness, earning valuable touchpoints with your audience and growing credibility. Social media’s primary role isn’t to get direct sales. Instead, its purpose is building trust. People buy from you after they gain trust in your brand.

A social media strategy helps you build relationships and show up more often, so the more often they see your brand, the more they recognize it and feel compelled to learn more.

Companies seeking rapid growth should double down on their social media efforts. Marketers should review data to determine the most engaging posts, which in turn will help businesses produce content that generates high engagement.

However, instead of becoming active on every social network, you should focus on your strengths, and let the data reveal the truth. The data may suggest you get most of your business from LinkedIn instead of Twitter, in which case you might consider doubling down on your LinkedIn model.

Remember, you don’t have to create an account for every social network. Focus on your top platforms and optimize them for better results.

Get your copy of The beginner’s guide to sales prospecting in the relationship economy

Ready to take your business to the next level?

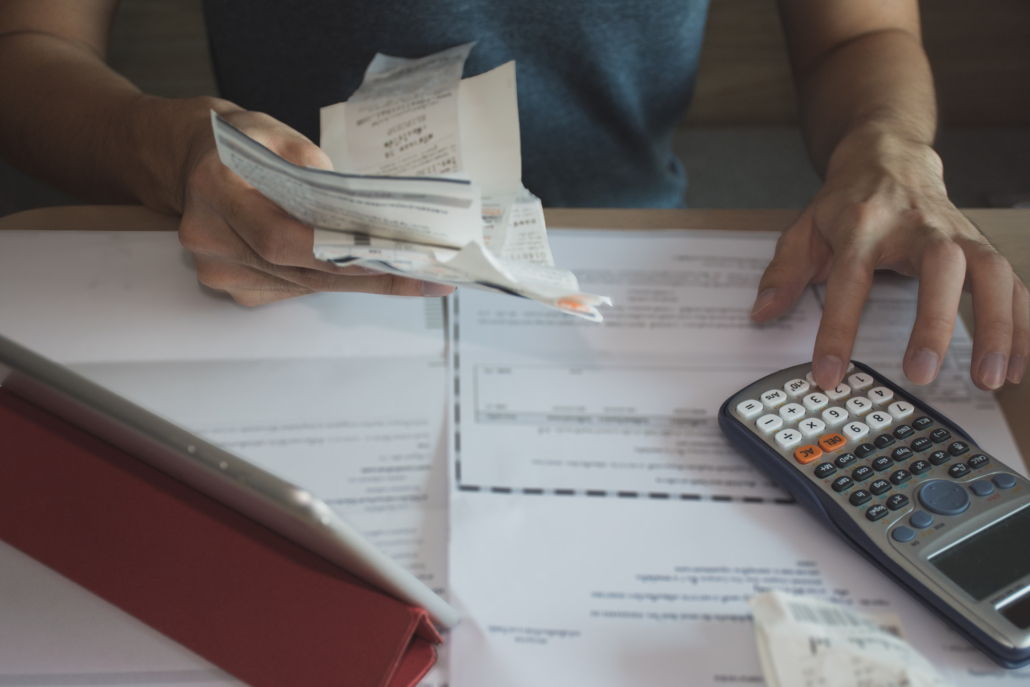

Rapid business growth takes time to build and maintain, and you’ll need enough working capital to fund your company’s initiatives. Luckily, there’s a smart funding solution for businesses feeling strapped for cash.

Some businesses get extra proceeds through invoice factoring, which helps you collect the majority of the invoice amount right away, giving you more predictability in your cash flow. Instead of waiting a few months for the customer to finally pay the invoice, your invoice factoring partner provides the majority of the funds up front, then will work to collect payment at the agreed upon terms. That frees you up to move forward in your business.

Liquid Capital is your trusted invoice factoring partner. We’ll provide the funds so you don’t have to wait months for customers to pay up. Learn about our invoice factoring services today.