Contact your closest Liquid Capital Office

Find your closest Liquid Capital office and speak directly with your local Liquid Capital Principal.

Please note: At this time, we can only assist companies that are incorporated.

You want to grow your business. Your ideas and customer / supplier stakeholders are ready but your balance sheet is not. Unfortunately, there is too much money tied up in accounts receivable. There is work that you’ve completed or product you’ve already shipped, you’re just waiting to get paid. Start accessing these funds through invoice factoring with Liquid Capital.

Factoring is an alternative form of financing ideally suited to small and medium-sized businesses, especially enterprises that do not have a long and established banking record with a major lender. In financial circles, there is a popular saying: “a bank only gives you money when you don’t need it.” That’s because banks operate on a line-based financing model based on what your business has already done and the assets you currently own.

Factoring is an innovative way for your business to access the funds you have tied up in accounts receivable.

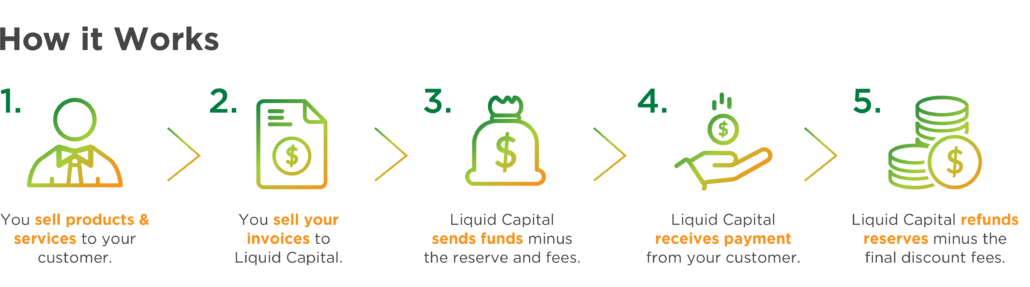

Liquid Capital effectively purchases your outstanding invoices and advances you up to 85% of the value. We then collect the funds from your client on your behalf and transfer the remaining balance to you, less applicable fees.

Think of your growing business like you’re driving a car. Major banks look in the rearview mirror – where you have been and what you have today. By comparison, factoring is all about looking through the windshield at where you’re going, and all the opportunities you have on the road ahead. At Liquid Capital, we look at where your business is going and give you the liquidity you need to get there faster, easier and with greater confidence.

In addition to business factoring services and other funding alternatives, Liquid Capital offers a fully integrated service bundle including:

By outsourcing these time-consuming tasks, you can concentrate on doing what you do best – growing your business. Our integrated service bundle means you will no longer be handcuffed by the time and money costs associated with administrative duties and paperwork.

–

Ready for funding? Let’s get started – fill out the form below.