Invoice factoring vs. bank loans: Which cash flow boost do I need?

If you’re looking for a bank loan, line of credit or traditional funding option (but might not even be able to qualify), there are other options. When comparing invoice factoring vs. bank loans, your business can access more cash flow, and faster. Here are 16 ways that invoice factoring can be the better option.

If you own or operate a company, you probably know the challenges of finding business funding. Relationships with banks are important, but sometimes bank loans don’t work out. That’s where alternative financing options such as invoice factoring, also known as accounts receivable financing, come in handy.

Invoice factoring allows you to access cash against your existing and ongoing customer invoices. You’ll work with an invoice factoring partner who will provide you working capital and take over the collections of those accounts receivable in return for a professional services fee.

When a company needs cash flow, invoice factoring can be the quick and reliable solution to keep your business heading in the right direction. Here are the additional bonuses to using invoice factoring vs. a bank loan that you may have never considered:

1. Get faster funding

If you need to urgently buy supplies, order product, make payroll or repair key equipment, invoice factoring can be easier and quicker to secure than traditional bank loans and lines of credit – sometimes as quickly as 24 hours after submitting your invoices. Unlike a traditional bank loan, you don’t need to submit tax returns, detailed financial statements, business plans or your financial projections – saving you a lot of time and hassle. Banks can also take longer to approve your requests, potentially making you wait for fiscal year end or the results of an audit. Instead, your factoring partner will perform an initial underwriting process to approve your application – then you’re all set.

2. Flexibility – Borrow more when needed

The amount your company can borrow will actually grow the more you sell. As your business grows, you’ll need even more cash flow to pay for supplies as you wait for customers to pay their invoices. So invoice factoring gives you the immediate ability to borrow more, and keep the growth going. Compared to traditional banks, you will never outgrow your line of credit, as a big enough factoring company can accommodate all your growth needs.

3. No other assets required

Factoring only requires that you have customer accounts receivable to secure your funding. You don’t need other assets like real estate, equipment or inventory to apply. That means your personal home or property doesn’t have to be offered up as collateral, which may sometimes be the case with traditional bank loans. (If you do have those other assets, you can also qualify for additional funding options like Asset-Based Loans).

4. Cash flow boost when you need it – now or ongoing

Whether you need a longer-term solution or a temporary boost in cash flow, invoice factoring can help you out of a tricky working capital dilemma. Every business will eventually run into the need for more cash on hand – so with factoring, as soon as new orders are invoiced you can have cash released into your business account. This gives you the chance to take advantage of growth opportunities that require more consistent cash flow.

5. Get larger funding than banks

Unlimited funding sounds amazing. With invoice factoring, lending power is dependent upon the size of your accounts receivable – so an abundance of working capital is possible. Banks qualify you based on your business credit strength, whereas your invoice factoring partner looks to your accounts receivable and your customer credit strength. If you’re selling goods or services to financially strong customers and have ongoing invoices, you can get substantially more financing than you’d qualify for with a traditional bank lender.

6. Grow your business the way you want

Instant cash means you can accelerate your growth strategy. Some companies need to hire more sales people to secure new accounts. Others will need additional equipment to manufacture their product. Still others may need working capital for marketing and advertising, office upgrades or new project development. Whatever the need, you’ll have the working capital to execute and grow the business.

Related: How high-growth companies can get unlimited cash flow

7. Take advantage of supplier discounts

Volume discounts, early payment discounts or special supplier offers are attractive options – but only if you have the capital available at that moment in time. Traditional bank loans are often not fast enough to allow you to take advantage of these discounts. But now, you can factor invoices quickly and free up cash flow to jump at the opportunities when they present themselves.

8. Shorten your cash cycle

Waiting for customers to make payment is a burden. With invoice factoring, you can significantly shorten your cash cycle. Instead of waiting 30, 60, 90 or more days for traditional payment terms, you can receive that payment from your factoring partner in as little as 24 hours. By the time your original terms would have come due, you could have now been able to purchase more goods, make more sales and earn higher profits.

9. Free up your time

Searching for funding and traditional bank loans is a time-consuming process. Meetings, business plans and applications take up a lot of your valuable schedule that could be spent on other areas of the business. With factoring, you’ll have to complete the application process, but once approved you can regularly factor your credit eligible invoices and save time while improving cash flow.

10. Lower your overhead costs

Since your invoice factoring partner takes over the management of your invoices, including handling customer payment and collections, your costs in these departments will likely lower. This can help offset any fees and makes factoring an even more attractive solution. You won’t get that service at a traditional bank.

11. Focus on new revenue

You and your team likely already spend a lot of time processing customer invoices and collecting payment – maybe too much time. With those duties removed from your to-do list, you can now work on other tasks that will improve your revenue like sales, marketing and building new client relationships.

12. Faster collections

Prompt and professional collections can be a big bonus when you work with the right factoring partner. With a reputable company handling customer collections, the result can be more timely payments (customers don’t want to risk a poor credit report). Once the customer makes their final payments, you’ll also receive your reserve funds from the factoring partner – so on-time collections are important to everyone.

13. Improved credit checks

Your factoring partner will also be responsible for credit-checking your customers. That gives you the advantage of having valuable intelligence about the creditworthiness of your clients, including new customers you may close. That can help improve the quality of accounts you take on, improve your credit decisions and advance your business’ debt security.

14. Less costs than equity investments – and you keep control

Equity investments and venture capital can be alternatives to traditional bank loans, but they can also demand much higher returns than the costs associated with factoring. In addition, you may be required to give up shares in your company, and that dilutes your ownership stake. It may even shift control of your business to the investors. But with factoring, there is no requirement to give up a stake in your business.

15. Protect against bad debt

In certain circumstances, some factoring companies offer non-recourse factoring, which means the factoring partner will take on the risk if any invoices are left unpaid. This type of factoring offers you additional protection against bad debt – a level of protection can be very important to some companies.

16. Improve your balance sheet

Invoice factoring is not the same as receiving a loan. On your books, a loan would get recorded as a “debit,” which is considered a liability. Instead, with invoice factoring there is no debt incurred. Your factoring partner is purchasing your accounts receivable with cash, and that reduces your balance sheet debt. The result will be a lower debt to equity ratio, and that can actually improve your financial position on the books.

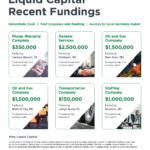

Now that you’ve compared invoice factoring vs. bank loans, you might be ready for the next step. Turn your open invoices into working capital with Liquid Capital’s Invoice Factoring solution.