What does the future of business funding look like?

The pandemic has changed the way businesses operate — including the finance industry. Some financial institutions have become more conscious of consumers and businesses during the past year and have pivoted to offer greater flexibility, support and leniency to borrowers. However, other businesses have experienced the opposite — with greater challenges accessing capital.

We’ve already seen the change come into effect in some parts of the world. In Canada, central banks have cut interest rates extensively, offering historically low borrowing rates to boost economic activity. In the U.S., mortgage lenders saw a rise in refinancing applications as the Fed lowered interest rates down to 3.45%.

But the changes brought to the financial sector go beyond slashing rates and offering more favourable borrowing terms. For leaders and CFOs of small and medium-sized businesses, this means they should be prepared to shift gears within their organizations and embrace the following future business funding trends:

1. Digital transformation

The banking industry is more keen than ever before to adopt technology that will help them assess credit-risk factors for borrowers and automate much of its underwriting processes.

Similarly, many business and finance leaders in small businesses will be investing in technologies to help them better plan and prepare for cash flow and manage expenses.

According to PwC, nearly one-third of CFOs surveyed already look to tech-driven products and services to revamp their business in light of COVID-related restrictions and allocate cash flow where it’s needed the most. Using digital savvy-tools, CFOs can better predict when they’re likely to experience slow cash flow months and apply for funding strategically.

2. Alternative lending

The harsh reality of the pandemic is that banks are only lending to SMBs with no risk at all.

It is a daunting task for businesses, which often have low-to-moderate risks associated with their organization, to receive funding from traditional financial institutions. Last year, about 70% of U.S. small businesses owners applied for the Cares Act Loan (backed by the Federal government but executed by banks) but it’s still unclear how many actually received any financial support. This is just one example of how banks run on a risk-averse basis.

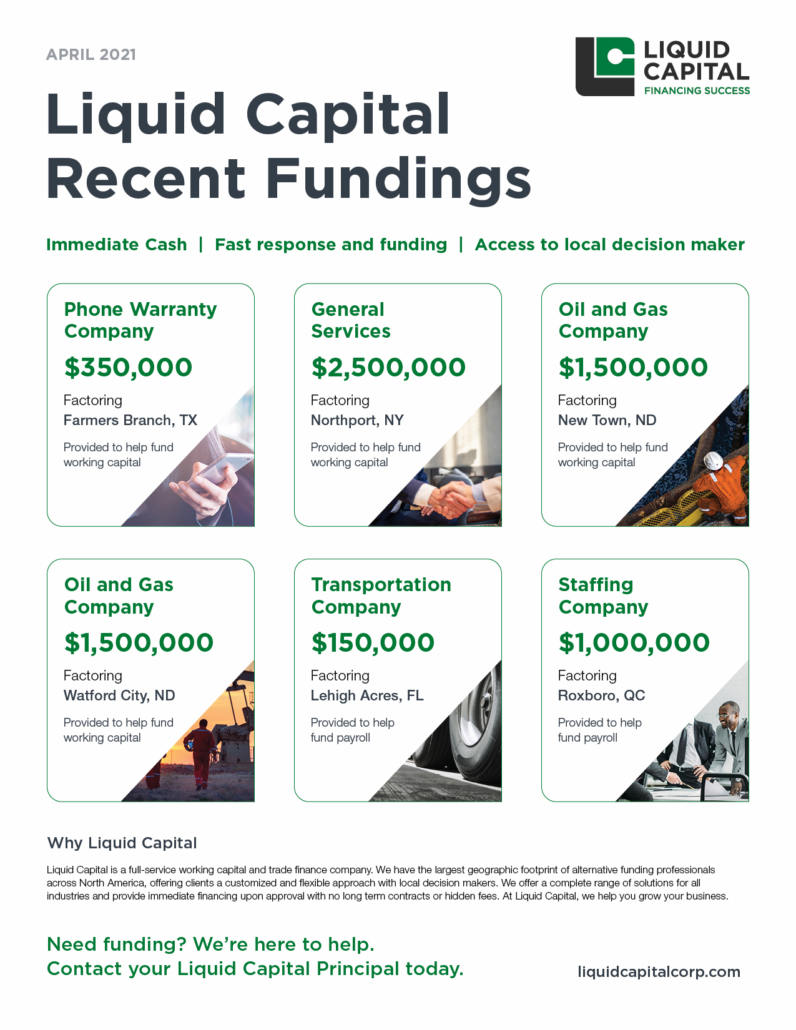

Instead, alternative lending companies have stepped in and reshaped SMB funding, helping to bridge the gap that traditional bank lenders cannot fill. Lenders such as Liquid Capital build relationships with businesses based on trust, knowledge, experience and expertise. This way, SMBs always have access to capital without having to go through a long drawn out process, without knowing if they’re even eligible for a loan or not.

3. Business funding will become more agile

Doing business is not just about getting your products to market — it’s also about protecting your cash flow. If you don’t have access to working capital, you can quickly fall behind on payments and find yourself in financial trouble before you know it.

In the U.S., 50% of companies now consider themselves under severe financial strain and millions have indicated they may have shut their doors for good. To help these struggling businesses, the banking industry will need to find creative, versatile solutions.

Many banks have started working with alternative lenders, such as Liquid Capital, and refer clients who don’t meet their underwriting standards to us. We are happy to work alongside our colleagues in the traditional banking system to ensure business owners, CFOs and leaders get the right product to keep their business healthy.

Our business funding services and products, including invoice factoring, asset-based lending, PO financing and other solutions, can be leveraged during various stages of business. During good times, this can further increase cash flow and help leadership make strategic moves. In downtimes, these solutions can help companies bounce back or prepare for an emergency by maintaining their cash flow during disruptive economic environments.

When you work with Liquid Capital to leverage invoice factoring (one of our main solutions), you get access to money owed to you through your open invoices — and get paid sooner. Many SMBs who are more familiar with traditional funding such as business loans and lines of credit are surprised to learn that invoice factoring does not add debt to your books. Instead, it quickly injects capital into your business.

Is your business prepared for the future of business funding?

As business leaders and CFOs consider how to prepare for the many changes the future will bring, the time is now to adopt new technologies that will help them streamline their cash flow, develop relationships with alternative lenders so they always have access to working capital, and be prepared for change and disruptions.