Toronto, Ontario (October 2019) – Next Edge Capital Corp. (“Next Edge Capital”) is pleased to announce the closing of a revolving credit facility for $47,500,000 USD with CIBC Bank USA¹ and NELI Canada LP², a special purpose funding vehicle utilized by the Next Edge Private Debt Fund (the “Fund”).

Next Edge Capital is an alternative investment management firm focused on finding value-added investment opportunities with a focus on private lending. Through the Next Edge Private Debt Fund, it has focused on providing lending capital to small and medium-sized business throughout North America, focused on factoring, asset-based lending and specialty finance loans with a client base represented in 7 Provinces and 32 States.

A challenge when managing a fund that provides lending capital is to manage cash by matching investor inflows to loan investment outflows. This involves planning for funding new loans still going through diligence anticipated to close and funding existing loans requiring additional draws while taking into account inflows such as unitholder purchases, and collections from interest and loan repayments. A significant benefit of this revolving lending facility will be to allow for a reduction in unutilized cash, in addition to increasing the efficiency of the Fund and the collective businesses that it works with.

The Next Edge Capital team and the Fund work very closely with the Garrington Group of Companies (“Garrington”). The Fund is a primary funding source to Garrington’s broad origination network; Liquid Capital, Blacksail Capital Partners Canada, Blacksail Capital Partners USA and IconiQ Finance. In addition, the Fund and each of these Garrington divisions utilize the services of LINE Financial to aid in underwriting, account management, administration, processing and monitoring of these transactions. The close symbiotic relationship between these various parties has allowed for significant growth over the years.

“We are delighted with the relationship with CIBC, they have truly been a great team to work with. The credit facility will aid in funding new loan opportunities and the operating efficiency of the overall collective businesses involved. We look forward to a collective, long-term rewarding partnership with CIBC for years to come,” mentioned Toreigh Stuart, CEO of Next Edge Capital.

“It’s always an honor and a pleasure to work with high caliber professionals like the team at Next Edge Capital, CIBC and our affiliates through the Garrington Group of Companies. We look forward to continuing to bring our best in class service and expertise to further strengthen and deepen this trusted relationship,” says Brian Center, President and CEO of LINE Financial Services Inc.

For more information, please contact Robert Thompson-So, Executive Vice-President and Chief Strategy Officer of LINE Financial Services at (416) 342-8292 or via email at rts@linefinancialservices.com; or Toreigh Stuart, CEO of Next Edge Capital at (416) 775-3636 or via email at toreigh.stuart@nextedgecapital.com.

¹ As Administrative Agent and Sole Lead Arranger.

² 100% of NELI Canada LP’s partnership equity capital is owned and provided by the Fund.

About Next Edge Capital

Next Edge Capital Corp. is an alternative investment fund manager and a leader in the structuring and distribution of Alternative and Private Credit fund products in Canada. Formerly a wholly owned subsidiary of Man Group plc., the firm is led by a management team responsible for raising over $3 billion of alternative assets since 2000. Next Edge specializes and focuses on providing unique, non-correlated pooled investment vehicles to the Canadian retail marketplace.

Further information can be found at www.nextedgecapital.com.

About Garrington Group of Companies

Garrington Group of Companies was established in January 2019 as part of a greater blueprint to develop a leading North American loan origination, underwriting and operations platform; handling Asset Based Lending, Factoring, and Specialty Finance loans ranging from $1 million to $30 million. Garrington’s creation comes from its acquisition of Liquid Capital at the beginning of 2019.

Garrington’s collective vision is to become the premier alternative SME lender in North America, supporting entrepreneurial companies with creative and optimal lending solutions, while providing a source of capital to support SME business development in North America.

Garrington recognizes the under-served market for small businesses attempting to secure working capital from traditional funding sources, based on the ever-increasing banking regulations governing the lending of money to smaller private and public companies. In addition, Garrington has identified, and is looking to capitalize from, the shift by alternative lenders away from smaller funding needs. Understanding the landscape of commercial financing in North America, Garrington has set in motion a plan to create a niche market to fund smaller borrowers on a large scale by adding further resources to its already large origination platform, in an attempt to reach borrowers right across North America.

Further information can be found at www.garringtongroupco.com.

About Blacksail Capital Partners (Canada & USA)

Rebranded to Blacksail Capital Partners from Next Edge Commercial Finance (In North East USA and Canada) in September 2019 to better reflect the change in ownership and becoming a member of the Garrington Group of Companies, Blacksail was established to complement Liquid Capital’s factoring business to focus on Asset Based Loans ranging from $1 million to $30 million.

Blacksail focuses its expertise on providing working capital solutions to the underserved small to the mid-sized middle market sector in North America. Serving many industries including; manufacturing, transportation and logistics, staffing, digital media and consumer goods, amongst others, the company strives to provide quick access to capital, which would typically be more flexible than banks.

Further information can be found at www.blacksailcapitalpartners.com.

About IconiQ Finance

IconiQ believes entrepreneurship is the lifeblood of the American economy, and it exists to empower entrepreneurs. In other words, the company is expert at breaking through the unique barriers to sustainable growth emerging companies face. Operating out of Austin, TX IconiQ provides revolving lines of credit and equipment term loans from $500,000 to $30 million lending on eligible accounts receivable, inventory and other tangible assets.

Further information can be found at www.iconiqfinance.com.

About LINE Financial

In 2019, as a part of a corporate restructuring and streamlining, LINE Financial was spun out of Liquid Capital with the sole purpose of providing third party due diligence, portfolio management and back-office services to the Liquid Capital system amongst others. The company strives to be the premier provider of comprehensive commercial finance infrastructure for entrepreneurial and visionary factoring and asset-based lending companies by creating, implementing and fostering premier commercial finance disciplines and processes with and for its clients.

The LINE Financial operations support loan origination teams with:

- Underwriting & Due Diligence

- Client Asset Management through a risk management team

- Collection & Verification

- Collection & Litigation

- Relationship Management

- Treasury Management

Further information can be found at www.linefinancialservices.com.

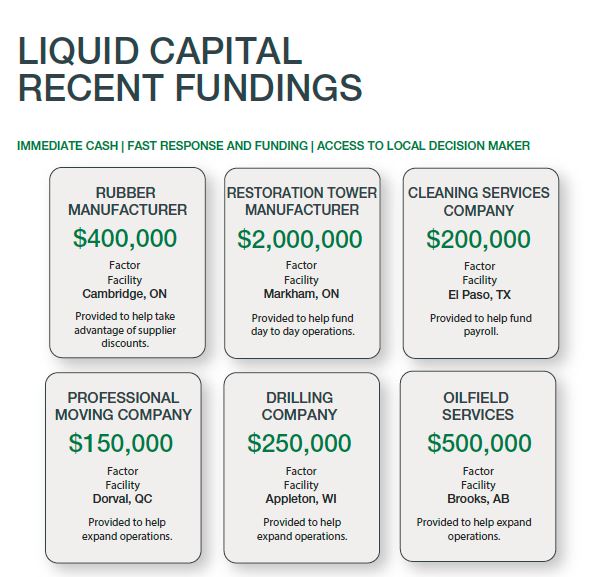

About Liquid Capital

Liquid Capital Corp. is a full-service working capital and trade finance network and has been in operations since 1999. The Liquid Capital network has the largest geographic footprint of alternative funding professionals, with approximately 45 independently owned businesses across North America, offering clients a customized and flexible approach with local decision makers. Liquid Capital offers a complete range of solutions for all industries and provide immediate financing upon approval with no long-term contracts or hidden fees.

Further information can be found at www.liquidcapitalcorp.com.