How to determine your company’s “cash conversion cycle”

Part 1 in the Cash Cycle series: Learn the basics of a “cash conversion cycle” and how you can use it to your company’s advantage.

Reaching success and growth in business requires a healthy cash flow. This allows your business to be prepared for the unexpected challenges and growth opportunities that will come your way. For example, if you buy and sell inventory on account, it’s critical that you know how long it takes to turn that inventory into cash.

As a business owner, you want to make sure you have the money you need when you need it, and the very last thing you want to experience is cash flow issues that restrict business operations.

Understanding your cash conversion cycle (CCC) is key to ensuring you’re on top of your company’s working capital.

Know your company’s cash conversion cycle

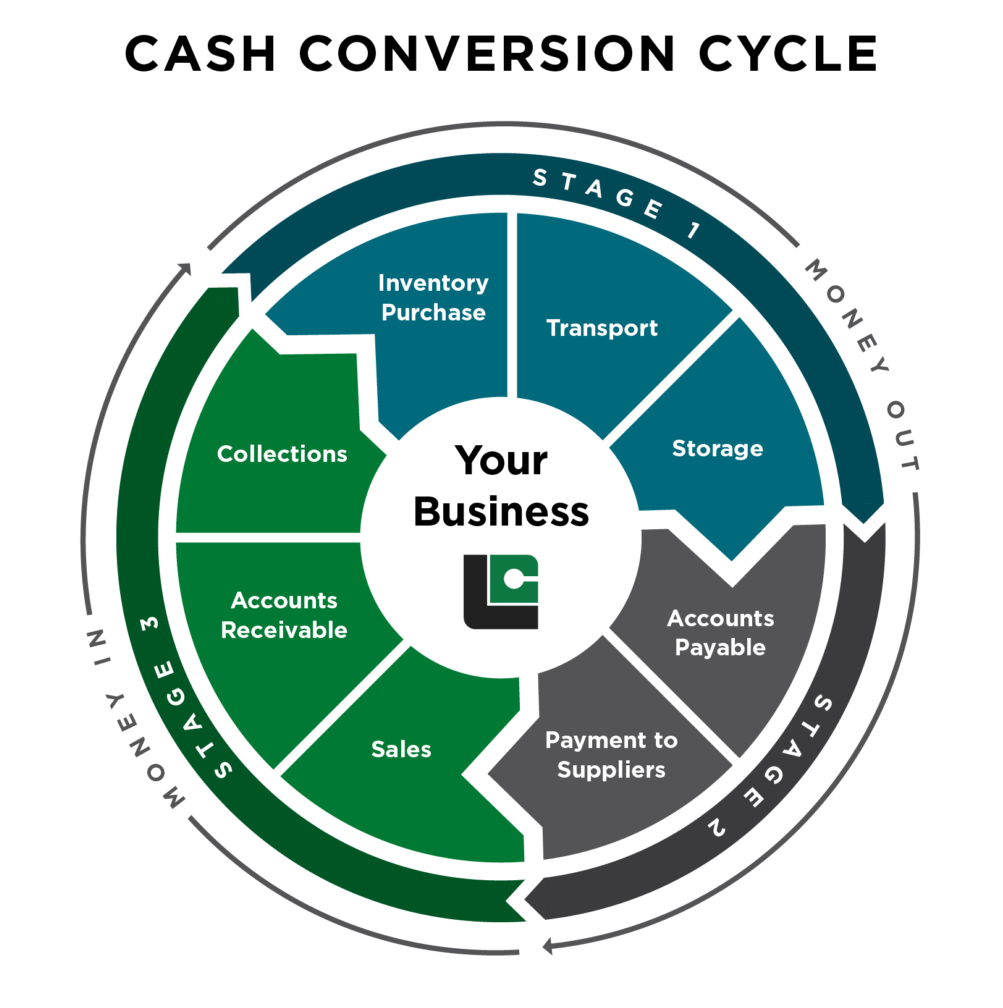

Your company’s cash conversion cycle (CCC) tells you how many days it takes to turn your inventory purchases into cash. It’s a cycle that is all too familiar: you acquire inventory from a supplier, store that inventory, sell it to a customer on account, pay your suppliers and collect on your invoices — thus getting paid and putting cash back into the company.

The CCC is an important financial indicator of your company’s cash flow. It shows your ability to maintain highly liquid assets and is a metric that lenders and other finance providers will use to assess your potential risk level.

It’s not magic, it’s just math

You don’t need to be a magician to unlock the power of the CCC formula for your business. All you need are three figures to complete the basic CCC formula, all of which you can find in your financial statements.

Let’s look at each component a little more closely.

- DIO: Days Inventory Outstanding

- This is the number of days on average that your company turns your inventory into sales. The smaller this number, the better.

- DPO: Days Payable Outstanding

- This is the number of days it takes you to pay your accounts payable. The higher this number, the longer you can hold onto cash, so a longer DPO is better.

- DSO: Days Sales Outstanding

- This is the number of days you’ll need to collect on the sales of that inventory after the sale has been made. Again, the lower the number, the better.

So the CCC is equal to the number of days it takes to sell your inventory, plus the number of days you need to collect on your sales, minus the days it takes you to pay your vendors.

Example:Keisha runs a PPE manufacturing company. Keisha always pays her suppliers within 30 days. She keeps enough inventory on hand to satisfy 60 days of sales and is good at managing this. It will take 52 days on average for her customers to pay their invoices.This would be her CCC formula:CCC = 60 days – 30 days + 52 daysCCC = 82 daysKeisha’s CCC is 82 days, meaning that she will need on average 82 days of working capital to convert purchased inventory into cash. |

The above is a simplified example, and to get accurate results you must calculate and track your DIO, DPO and DSO on a monthly, quarterly or annual basis, along with the dollar values for inventory and sales.

“Our Liquid Capital Representative is more than just a lender — he’s a built in consultant.”

Nick Newman, Co-owner, Ridgeline Manufacturing

How the Cash Conversion Cycle reveals hidden potential

Now that you have gathered the necessary numbers and ran them through the CCC formula, you will have a good indication of your cash liquidity position — and it can point your attention to what is helping or hindering your cash flow. Depending on the results, you may determine immediate areas that can be improved.

The longer the CCC, the more working capital you’ll need to manage your operations. And that can be an overwhelming challenge for many businesses. Generally speaking, companies want to shorten their CCC.

To shorten the CCC, you may be able to manage inventory levels better, get longer supplier payment terms, improve your collection process or adjust the payment terms you give your customers. However, this may not always be practical or something you’re wanting to change for a number of reasons.

“Liquid Capital allows me to operate without stress. If a company is offering early payment discounts, factoring is a cheaper option to gain access to money.”

Dave Kip, CEO of Best Broadcast

Making adjustments that fit your business

Choosing to use an alternative financing solution such as Invoice Factoring can help to lower your CCC by turning accounts receivable into cash faster.

Factoring can help to lower your DSO which means that you will get paid on your sales faster and have quicker access to working capital. This cash can then be reinvested into your company faster than if you had to wait on outstanding invoices to be paid out according to the usual payment terms.

Or you could get extended payment terms from suppliers to reduce the DPO portion of the formula or use financing tools such as Purchase Order Financing to help you make up the gap where suppliers are not providing adequate or any terms. By extending the number of days you have to settle your accounts payable, you can keep cash in the company and effectively increase your working capital.

However, the CCC alone cannot be a complete indication of liquidity. You’ll need to look at calculating other liquidity metrics like the current ratio and quick ratio to paint a complete picture. You may already have these calculations in place, but if you haven’t yet calculated your cash conversion cycle, it’s time to start crunching the numbers and tracking changes over time to manage your business better.

Reducing your DSO and DIO or stretching your DPO are also useful tactics that can help your cash conversion cycle to grow your business. Do you work in an industry where “inventory” doesn’t apply? There are also other ways that you can use the CCC. |

Keep reading our four-part cash conversion cycle series:

Part 2: Learn about the 7 proven cash flow tactics every CFO and finance pro needs to know.

Part 3: Learn how to leverage your assets to grow your working capital

Part 4: Learn how to keep suppliers happy and cash in your pocket