Looking to grow your business or help your client grow theirs? Our working capital checklist will help with efficient growth and agility.

To ensure long-term success, resilience and agility to tackle whatever comes your way, having an optimal level of working capital is key to operating efficiently and realizing your growth plans.

Once you’ve found ways to optimize your working capital, it is also crucial to maintain clarity over your cash flow situation. Regularly evaluating the health of your working capital will not only ensure you know how your business is positioned to handle upcoming obligations and opportunities — it can also provide you with an early warning of potential challenges.

In an uncertain market, knowing whether your cash flow is optimal for your business to function is especially important. As one 2022 survey found, 60% of global business leaders, finance and accounting professionals said they expected understanding cash flow in real-time to become more important for their company in uncertain times. Nearly all participants said they wanted more confidence with their current visibility over cash flow.

Evaluating your working capital doesn’t have to be complicated. Implementing the checklist below can give you the confidence that you’re on the right track — or the information you (or your client) need to take action.

Get to know your cash flow position each month with this checklist:

Evaluate your cash flow situation monthly

Evaluate your cash flow situation monthly

While your working capital may have been sitting at a healthy level six months ago or on your last financial statement, economic and industry conditions can change rapidly, affecting supply chains, the cost of inputs or demand from the end customer. Having regular insight into your cash flow position ensures you have the funds available to meet payroll, order inputs and take advantage of new business opportunities.

Keeping an eye on your cash flow statement — which shows you how money moved in and out of your business over a certain period of time — can give you important insight into your liquidity on a monthly basis.

Calculating working capital by using the current ratio (assets divided by liabilities) is a quick way to evaluate whether you have enough cash on hand to meet your near-term obligations. Numbers vary by industry, but a current ratio between 1.5 and 2 is generally considered healthy by most analysts.

Current ratio = Assets / Liabilities

Knowing your company’s cash liquidity position, as calculated by your cash conversion cycle (CCC), is also crucial to ensure your working capital is not out of balance.

To calculate the CCC, take the number of days it takes to sell inventory minus the days it takes you to pay vendors plus the days you need to collect on invoices.

Cash conversion cycle = # of days to sell inventory – # of days to pay accounts payable + # of days to collect accounts receivable

One way to monitor cash flow indicators, as BDC explains, is to set up a financial dashboard either via your accounting software or on an Excel spreadsheet. This dashboard can display your sales, inventory outstanding and other metrics, such as the average number of days it takes you to collect your receivables.

Forecast your cash flow for the short and long term

Forecast your cash flow for the short and long term

Having an idea of periods in your business where cash flow may be positively or negatively affected — whether by seasonal sales trends, supply chain issues or industry-specific concerns — is useful when it comes to identifying risk and taking action to keep your working capital healthy.

Creating and regularly revising your cash flow budget will give you crucial insights into estimated sales and projected cash inflows and outflows. These are a good indication of whether your beginning balance at the start of each month is adequate for your business or if there are certain months you may run short on cash.

Along with monitoring your short-term cash flow situation with a monthly forecast, you should also prepare long-term cash flow forecasts that look 6 to 12 months ahead.

Review your targets regularly

Review your targets regularly

With financial projections in place, take time to regularly check whether your actual cash flow meets the minimum balance you set out in your cash flow budget.

Comparing metrics like your CCC to previous periods or even industry peers can also indicate whether you need to address your inventory or accounts payable, to shorten the cycle and free up working capital.

Maintain the health of your account receivables

Maintain the health of your account receivables

Ensuring your clients pay their invoices according to agreed-upon terms is an important part of maintaining a healthy cash flow. Staying on top of accounts receivable via aging reports or by customer, for example, will give you regular insight into whether payment is happening as expected or if there are delays.

Consistently auditing your receivables process to see if there are ways to accelerate payment is also key — and may even enhance your customer’s experience. For example, are there ways to further automate invoicing? Are you billing as soon as your service is completed or the product is delivered?

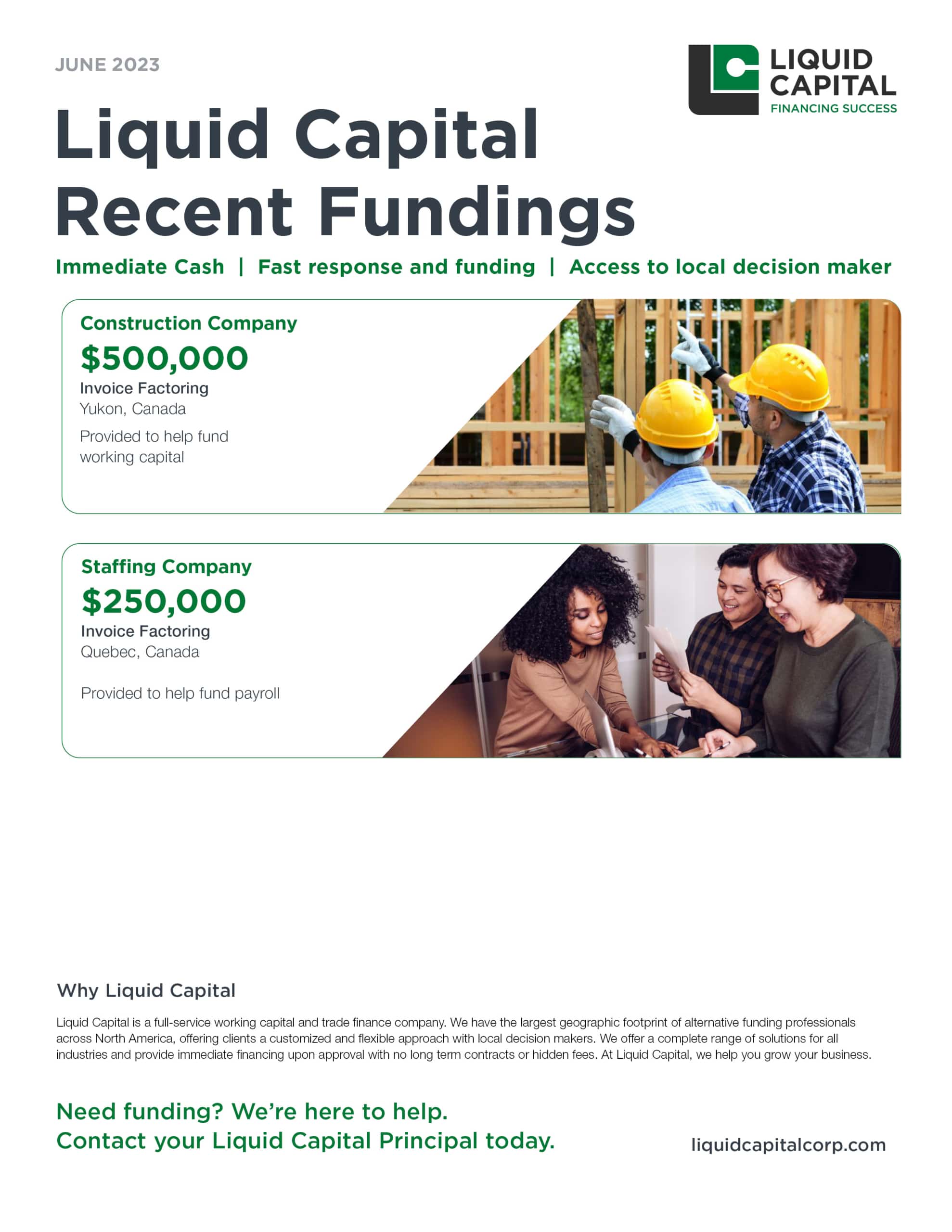

If invoices are still held up in accounts receivable for 30, 60 or even 90 days, invoice factoring is one solution that can help to eliminate bottlenecks, free up cash and boost the health of your working capital.

Evaluate your cash flow situation monthly

Evaluate your cash flow situation monthly