5 ways to finance a business in a slow economy

The business funding landscape is continually evolving, in part due to economic shifts and business demands. Here are some innovative ways to finance a business or your next strategic plan.

Gone are the days when commercial banks were the only safe lending choice and even then so many rules and regulations made it hard for SMBs to obtain a loan. According to Dun & Bradstreet, bank loan success rates stood at 32% (initially 41%) for small businesses and 89% (down from 95%) for mid-size companies.

Thankfully, there are many alternative sources of funding out there besides traditional loans that SMBs can use to raise capital. Many have been around for some time, but others are relatively new and emerged over the past several years.

Keep an eye on the terms of any funding deal, as some will be more favorable than others. Here’s a quick overview to help you understand the different types of funding and lending:

Five ways to finance a business in 2021

1. Invoice factoring

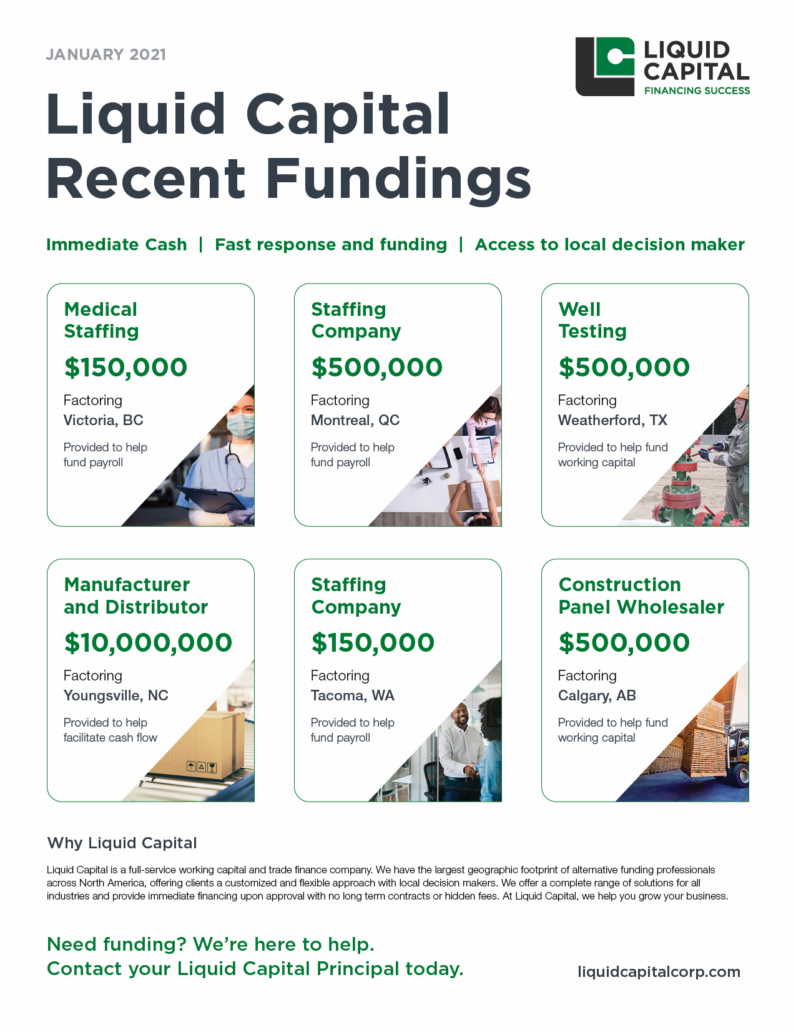

Invoice factoring is one of the most common ways to finance a business. You get quick access to cash by selling your accounts receivable to a financial institution or factoring company (also known as a factor). Businesses often use a factoring company to help inject cash flow and manage slow-paying customers.

As part of the process, the factor pays a portion of the accounts receivable — typically 75% to 80% of an invoice — and keeps the remaining amount as a reserve. Once the final invoice is collected, you’ll receive the reserve funding back (minus a small fee), keeping the cash flow…well, flowing. The higher the invoice capital or the more credit-worthy the customer, the more you’ll be able to borrow.

The main upside to invoice factoring with Liquid Capital is that you receive a partner who is willing to take the time to understand your business. This is important when there are a multitude of considerations and implications, with various choices and options that you might not be aware of yet.

Related fact: While invoice factoring is in wide use in today’s business world, it’s one of the oldest funding methods, dating back to ancient Rome!

2. Peer-to-peer lending

You may have heard about this lately, and we recently explained it in another article. Peer-to-peer lending, also known as social lending, connects investors and borrowers together on a digital platform. The platform acts as a middleman and doesn’t actually give out any loans. Instead, it facilitates the lending and brings together a community of like-minded individuals that share an entrepreneurial zest.

A growing number of P2P business lending platforms offer a diversity of loans and act as a pitching service to connect businesses with investors. This type of funding is geared towards more established companies looking to grow and typically requires a thorough pitch deck to showcase. Not all businesses will be at the right stage to focus on this, nor have the time and capacity to fulfill all requirements.

3. SBA microloans

If you’re based in the U.S. you can apply for a microloan program that awards up to $50,000 loans to help grow your business. North of the border, there are also many microloan options for Canadian businesses.

These loans are made available through nonprofit community-based organizations and help you increase working capital and buy inventory, supplies or machinery. They also have relatively low-interest rates, generally between 8% and 13%.

The upside to this type of funding is that lenders may also provide some degree of consultation services, so you’re able to get direction and industry knowledge to move your business forward. However, the one catch is that some applicants may need to go through training before their loan request is even considered, to make sure they are exemplary candidates and deserving of the funding. If you’re in need of fast funding, consider the timing.

4. Fintech lenders

Many online lenders have emerged due to a rise in fintech capabilities. These lenders provide smaller loans, credit options and quick loans through their online storefront.

Many SMBs see them as a useful substitute for an immediate cash-flow problem, but doing business with these lenders has its own set of benefits and limitations. The trick is to do your research and understand what kind of lender you’re dealing with.

Look into their online reputation, and most certainly take the time to review customer feedback. When researching an online lender, you should also look into their contract terms, interest rates, along with any additional fees and charges. And always find out if an online lender will register security against your business. Some may even do this for a basic application — even if you don’t borrow money from them — which can put you in a worse position. Also consider whether expert consultation would be helpful in your circumstance – someone who will take the time to understand the bigger picture and goals for your business. Fintechs are generally transactional, which can work in some situations if you know exactly what you need.

5. Merchant cash advance

If you accept card payments, you can apply for a merchant cash advance loan (MCAs). When you borrow through this method, a lender gives your business cash upfront in exchange for a commission or a part of future credit card sales. You pay back the loan from the percentage of the business’s daily transactions.

The biggest downside to MCAs is that they can get quite expensive. In fact, based on this estimate, they can have annual percentage rates (APRs) as high as 350%. Business owners in a tight spot that go for this lending option are pursuing one of the costliest forms of financing..

While MACs can offer a quick fix for cash flow problems, they are in no way a long-term solution. How do you expect your business to thrive when someone’s eating into your profits every single day?

While there are a few options for SMBs to consider in solving cash flow needs, it’s recommended to slow down and look a little deeper at the options – and the funding providers – before deciding.

Always work with a partner who is willing to take the time to understand your business and your needs. A good partner will have your back and keep you protected.

At Liquid Capital, we understand what it takes for small, medium, and emerging mid-market businesses to succeed – because we’re business people ourselves. Our company is built on a network of locally owned and operated Principal Offices, so whenever you’re talking to Liquid Capital, you’re talking directly to your funding source and a fellow business person.

Images by Adobe Stock and Pixabay: Featured, body 1 and body 2