In challenging times, optimize your working capital for success

When a business needs to adapt and pivot, having sufficient resources and funds are critical. Here’s why you (or your client) need to optimize your working capital.

Whether dealing with supply chain issues, inflation concerns or the rising cost of inputs, North American business owners in almost every sector are facing another year of adapting and pivoting. For most, having sufficient working capital is key to surviving and thriving in unpredictable market conditions.

While North American markets continue to recover from post-pandemic market uncertainties, the supply chain continues to experience pressures that are affecting businesses in the United States and Canada. For example, U.S. storage prices continue to increase, up 1.4% month-over-month and nearly 11% year-over-year.

In an uncertain environment, sales are only one part of the equation. Keeping a close eye on the full state of your finances can ensure your business is operating as efficiently as possible and that you have the balance you need to weather volatility.

The benefits of optimizing working capital

Properly managing your finances ensures you have cash on hand to meet day-to-day responsibilities — mainly payroll and ordering inputs from suppliers. Working capital optimization also means your cash is being used efficiently.

Working capital takes these factors into account:

- Assets – cash, accounts receivable and inventory

- Liabilities – accounts payable, taxes payable and debt to be repaid in the next year

Regularly reviewing each of these elements, and how they work together, is crucial during challenging times. Even if your client’s financial situation seemed stable just recently, industry, seasonal and market factors are constantly in flux, which can change parts of the equation — such as the number of days accounts receivable are outstanding — on short notice.

When you actively optimize your working capital levels, you’ll be able to meet short-term obligations, pivot and respond to challenges, such as supply chain fluctuations or inflationary pressures. It will also allow you to take advantage of opportunities to grow.

Three steps to help optimize your working capital

Moving forward with confidence in this market means having the right balance of working capital. The good news is, you can take action to optimize it now. Here’s how to start:

1. Know where you stand

Start by looking at your liquidity. To do this, calculate your working capital ratio: current assets divided by current liabilities.

Working capital ratio = Current assets/Current liabilities

The working capital ratio will give you a sense of whether your business has enough cash on hand to meet day-to-day responsibilities, but not so much that you’re missing out on opportunities to put it to work!

Depending on the industry, most analysts consider a healthy ratio to be between 1.5 and 2.

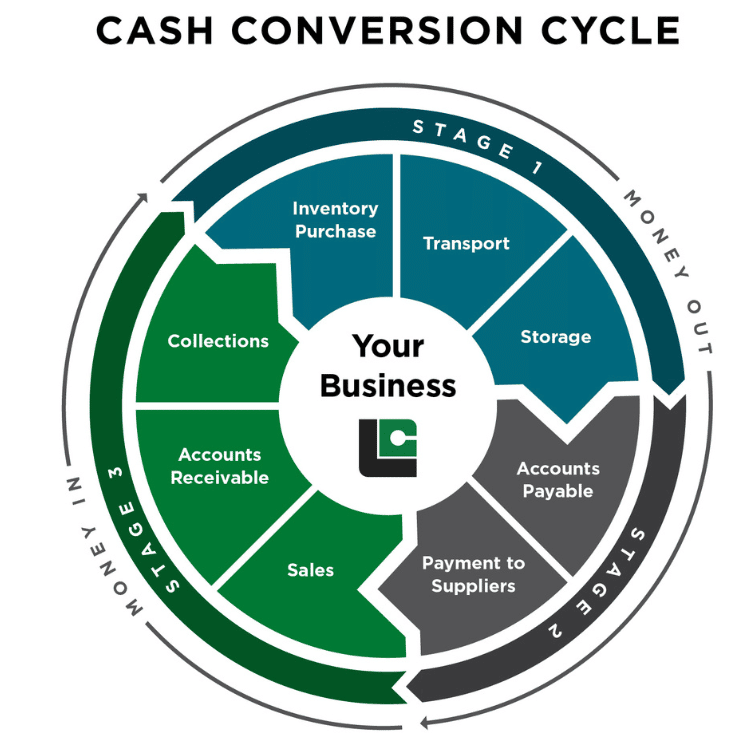

You’ll also want to take a look at your cash conversion cycle (CCC) — a financial indicator of your cash liquidity position and ability to maintain highly liquid assets.

The CCC is calculated by taking the number of days it takes to sell inventory minus the days it takes you to pay vendors, plus the days you need to collect on invoices.

Cash Conversion Cycle = Number of days to sell inventory – Number of days to pay vendors + Number of days to collect on invoices

Ultimately, the results can point you to areas you may need to improve, such as the number of days it takes to receive payment on an invoice.

2. Take control of your receivables and payables process

To optimize a working capital ratio that is less than ideal, consider making changes that may help free up cash on both the accounts receivable and payable side:

- Strive to streamline invoicing: Getting paid promptly means minimizing chances for delay or dispute. Clarity and timeliness are key — start by sending out invoices as soon as the project or order is complete. Make sure your invoice contains the full name and address of your business and your tax number. Also ensure the invoice clearly lists terms (such as net 30 days) and a purchase order number. To avoid disputes, itemize invoices and confirm charges, attaching backup documentation if possible. Send out friendly reminders at certain points after the invoice is sent and once the due date passes.

- Increase automation: Moving to digital tools for generating, sending and paying invoices may help speed up the payment process and eliminate manual errors. A recent survey found automation of the accounts receivable process led to a 60% decline in missing invoices and a 59% reduction in delayed payment.

- Request incentives for early payment: On the accounts payable side, consider leveraging your positive relationships with suppliers to negotiate a discount for paying outstanding invoices early or request flexible payment terms. You may also be able to take advantage of discounts if you purchase supplies in bulk.

3. Take action to address gaps

If your working capital is still off-balance because cash is tied up in accounts receivable, with customers paying invoices at 60 or even 90 days, it may be time to seek an alternative option. Consider how solutions such as invoice factoring may be able to alleviate cash flow issues quickly by turning your near-term assets into liquid capital that you can use immediately.

By selling your credit-worthy invoices to Liquid Capital, you can receive 80% or more of the value of your accounts receivable, eliminating bottlenecks and allowing you to more effectively manage your finances.

Regularly reviewing and managing your working capital will put you in an ideal position to meet changing industry and economic conditions head-on.