How do you pinpoint amazing funding companies? (Hint: It’s the people)

Look out for these human-centered characteristics from great funding companies.

As a business owner, what do you look for when starting a new partnership with a lender? You’ll take the obvious parameters into account — such as their ability to fund your business. But how often do you establish relationships based on a human-centered approach?

It’s easy to forget that real people are behind funding companies because you may not always have faces put to names (especially online lenders). But there are funding companies out there who take a more personal approach, including us at Liquid Capital. We are rooting for our clients and their businesses to succeed, and we want their teams, revenue and profits to grow.

Next time you’re searching for a funding partner to invigorate your business cash flow, these are some of the additional characteristics you should look for:

Great funding companies build relationships

A funding company that looks beyond dollars and cents is someone worth partnering with. Look for someone who can follow your struggles and understands what you’re going through, especially in unpredictable economies.

At Liquid Capital, our ability to connect with clients at a human-level based on trust, experience and knowledge is what makes us stand out from our competition. Instead of developing one-way access to lending, we promote a reciprocal partnership that encourages business owners to lean on us for anything business-related.

One day we might be assisting our client in finalizing a new supplier. The next day, it could be supporting them to open a new warehouse location. It’s involvement like this that makes us stand out and puts us at the heart of business funding today.

Great funding companies understand the immediate and future needs of business owners

If your business is going through a cash shortage, chances are you need the problem resolved ASAP. When you work with a funding partner, they should perceive critical business challenges and provide timely and convenient solutions.

But a great lending partner will also try to identify why there was a working capital gap in the first place — and anticipate future funding needs. In this case, their goal should be to offer continued support so you can rely on them to help you meet ongoing challenges.

Great funding companies are industry specialists

At Liquid Capital, we have experience and practice in almost every industry and market. Working with a lending partner who understands specific industries will significantly benefit you — and not just in terms of funding.

Not only do they know the ins and outs of how particular markets work and how invoice factoring can be beneficial, but they can also use their knowledge to resolve problems and offer strategic insight.

Great funding companies are willing to ask the hard questions

It’s important to work with a provider who’s ready to ask difficult questions to learn more about your business and see if there’s a fit.

Are they inquiring about your credit score? Do they ask about past bankruptcy filing or insolvencies? Have they figured out if you’ve been making payments on time? Will they delve into the health of your relationships with vendors and clients?

Although it may be awkward to answer these questions, they’re willing to learn more about your business so they can lead you to a funding solution that’s affordable and wise.

Great funding companies will educate you

Ideally, you want someone who will offer you advice and feedback to help you grow your business. After learning more about your operations, they can pinpoint what’s working and acknowledge areas to improve productivity and output.

Equipped with industry knowledge and experience, we help clients achieve a firm position in the market by continually educating them on best practices and answering questions that fuel business growth.

Great funding companies are realistic

We know it’s hard to hear ‘no’ if you’re in need, but a responsible funding partner won’t be afraid to decline an application request if it doesn’t make a good fit for your business. If that happens, they should also provide practical feedback on what you may need to adjust to qualify in the future.

Likewise, if you’re applying for a particular funding product but another solution is better for you, they should offer that advice. You don’t want to be working with a company that will sell you a service that’s beyond your affordability or does not provide the optimal solution to your funding challenges.

Great funding companies have proven success

Successful lenders can showcase results in the form of case studies, recent fundings and client testimonials. Don’t be afraid to ask them how they’ve helped clients achieve their goals, overcome a unique problem, or enjoy growth with their support.

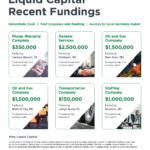

At Liquid Capital, we walk the talk. Here are some of our success stories that prove why our clients love working with us and how we help them achieve their business goals.

Funding is about more than just numbers

Liquid Capital is committed to the long-term success of SMBs and we realize that doing business is about more than earning money. (Naturally, that is important, and we want you to be as successful as possible!)

But business is also about making genuine connections, helping clients beyond their expectations, and working together with a more inclusive approach. With all the qualities listed above, we’re confident that our clients have the support to grow their business.

At Liquid Capital, we understand the struggles and challenges of small, medium and emerging mid-market businesses – because we’re business people ourselves. Our company is built on a network of locally owned and operated Principal Offices, so whenever you’re talking to Liquid Capital, you’re talking directly to your funding source and a fellow business person.