3 Cash Flow Nightmares & The Dream Solution

New customer orders are a business owner’s dream. But the sleepless nights come when you’re waiting on payments. Getting paid on time, and earlier than ever before, is possible. Learn a cash flow solution for these common business challenges.

The 3 Cash Problems Keeping You Awake

In B2B, you likely invoice clients for large orders and collect on 30, 60 or 90-day terms. The quicker you turn these invoices into cash, the faster you can grow your business operations.

If your business is in high growth, you may have a lot of your money tied up waiting for those payments to come through. Or there could be times when customers don’t pay up on time, leading to poor cash flow and working capital that is stretched to the max. Your receivables have just caused a chain reaction of problems.

Problem One: Fulfilling orders.

You get a big order but your money is tied up. Do you say no to that new customer?

Problem Two: Paying suppliers & taking advantage of discounts.

You have your own accounts payable, but can’t pay on time. And suppliers will often provide timely discounts, but you don’t have the working capital to take advantage.

Problem Three: Paying your staff.

Low cash can lead to payroll problems and your valuable staff walking out the door. The resulting turnover costs and headaches can be greater than ever expected.

Can’t My Bank Help? Not Always…

Most business owners will first approach their bank for short-term financing, but banks could easily reject your request if it doesn’t comply with their criteria.

Without great credit, enough collateral, positive cash flow and a proven track record, getting working capital from a traditional lending institution is extremely tough, whether you’re a large enterprise or a newer SMB. Even if you are approved, by the time you receive your funds, your working capital might be exhausted long ago.

B2Bs have faced this dilemma for years, but there’s a financing option some business owners haven’t discovered called “Accounts Receivable Factoring” that can help solve these cash flow problems.

How Does Factoring Work?

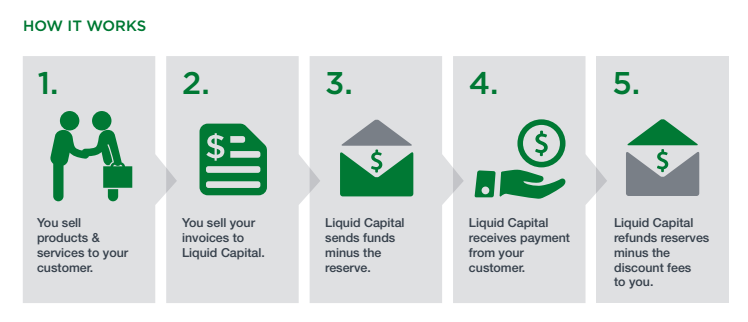

If you’ve never heard of Accounts Receivable Factoring before, you’re not alone. But it’s been a standard financing practice in Europe and other developed nations for years. Liquid Capital specializes in it and has developed a world-class business to help you get cash in hand. Here’s how it works.

1. You make a sale to your customer. (e.g. With a 30/60/90 term)

2. You submit that invoice to your Liquid Capital Principal.

3. Liquid Capital buys your invoice from you, putting cash in your business within as quickly as seven days.

a. You’ll get 75% or more of the invoice value at this point. A reserve fund is held until step #5.

b. At this point, the money is in your pocket and you can use it to wipe out your cash flow problems.

4. Liquid Capital will collect from your customer on your behalf, which also alleviates strain on your internal A/R department.

5. When the customer finally pays, Liquid Capital will refund you any additional reserve funds minus the discount fees.

This process can fast-track your cash cycle by anywhere from three weeks to three months or more! With faster access to working capital, you’ll be able to fulfill orders, take advantage of supplier discounts and pay your employees faster and more efficiently.

A Long-Term Cash Flow Solution

Liquid Capital is a market leader and works with you as a trusted partner, not as a one-time lender. We have over 80 trained Principals across North America who are business owners themselves, and they each work directly with clients to develop business relationships, face-to-face whenever possible.

A Liquid Capital factoring solution can give you cash up front for your sales, helps you spend less time and employee expenses on collections, and ultimately helps you graduate to a traditional bank loan option. The factoring process is so beneficial that many clients will choose to work with us alongside their banks for various financing options, depending on their needs.

We know that growth-oriented B2B owners don’t wake up in the morning thinking fondly about collecting on their accounts receivable. So as a business partner, we lighten your worries through financing solutions that put cash in your pocket. And better yet, it will help you get a good night’s sleep.